Founding Engineers, Part 2

Risk tradeoff for early stage startups

After I published “Founding Engineers” last week, I’ve got a lot of pings on LinkedIn for people who want to join me. Throughout the conversations, I found myself repeating the following points to many, so it’s probably worthwhile documenting it here.

Facts (with give-or-take numbers):

Most early stage startups fail.

20% of startups reach Series A.

Early stage startups are short on cash (see Carta’s data):

Typical Pre-Seed or Seed funding is $0.5-5M.

Typical Series A funding is $3-10M.

In other words, for most startups, they have much smaller bank balances, and they are before Product-Market-Fit (PMF). Therefore they prioritize 2 things:

Build initial product and iterate fast, to aim for PMF

Save cash, to prevent from running out of money before securing Series A funding

This means, for a typical FAANG engineer, early stage startups can’t compete in salary / compensation at all, not in the short term.

You might ask, maybe in the long term, early stage startup compensation could be worth more, when the company valuation goes up?

It turns out, because of the high failure rate, the expected value of such equity based compensation still is lower than the expected value of big tech pay.

If money is the main deciding factor for you, big tech is a much better option.

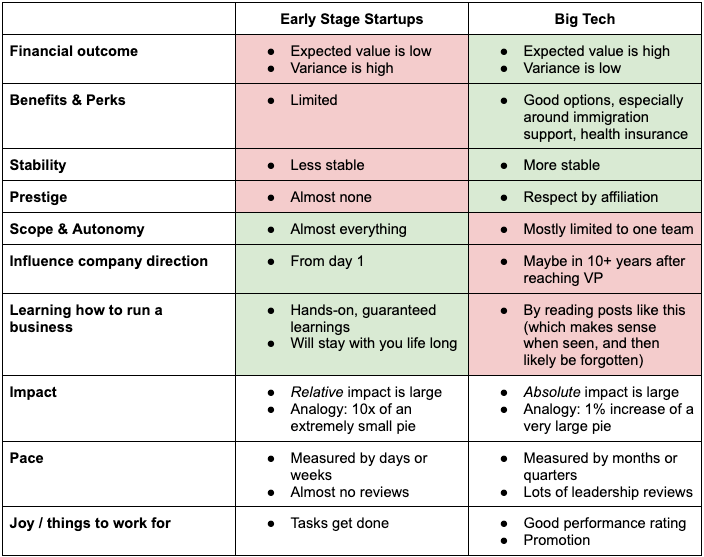

In the event money isn’t the only factor, I put the tradeoff in the following table. Note that the last 3 rows don’t have clear winners between early stage startups and big tech. They are more on which way fits a person’s style better.

In summary, here’s my pseudocode for someone in US:

if need_immigration_sponsorship:

choose_big_tech

return

if need_cash_or_good_insurance:

choose_big_tech

return

if prestige_or_stability_matters:

choose_big_tech

return

talk_to_early_stage_startups

![Request] can someone please explain the stats behind this meme? : r/theydidthemath Request] can someone please explain the stats behind this meme? : r/theydidthemath](https://substackcdn.com/image/fetch/$s_!nZhN!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F91a974bf-fd85-494c-b41d-0e2d75df9664_640x496.jpeg)